Visa launches 2nd edition of She’s Next in partnership with MCIT, Monsha’at, and ANB Bank to support women-owned small businesses in Saudi Arabia

Riyadh: Gulf Tech News

· Visa launches 2nd edition of She’s Next in partnership with MCIT, Monsha’at, and ANB Bank

· Local women business owners are invited to apply for a grant worth USD50,000, a tailored training program and access to She’s Next Club networking and mentoring opportunities. Applications are open until June 23, 2023

· As part of initiative, Visa launches ‘Women SMB Digitalization Index’ for KSA, which addresses key motivations for starting a business, core challenges, and digitalization

Visa, the world’s leader in digital payments, has launched the second edition of its global She’s Next initiative in Saudi Arabia in partnership with Ministry of Communications and Information Technology (MCIT), Monsha’at, and ANB Bank. She’s Next, empowered by Visa, is a global advocacy program that aims to support women-owned small businesses through funding, training and mentorship. From today and until June 23, 2023, women entrepreneurs from all industries and sectors in Saudi Arabia can apply to She’s Next.

One winner will receive a grant of USD50,000, a tailored training program, and access to She’s Next Club resources such as a workshop library and community of entrepreneurs.

Ali Bailoun, Visa’s Regional General Manager for KSA, Bahrain and Oman, commented: “We’re proud to bring the second edition of our successful global She’s Next program back to KSA. We are grateful to our partners for their support in bringing this important initiative to women owned businesses in the Kingdom.”

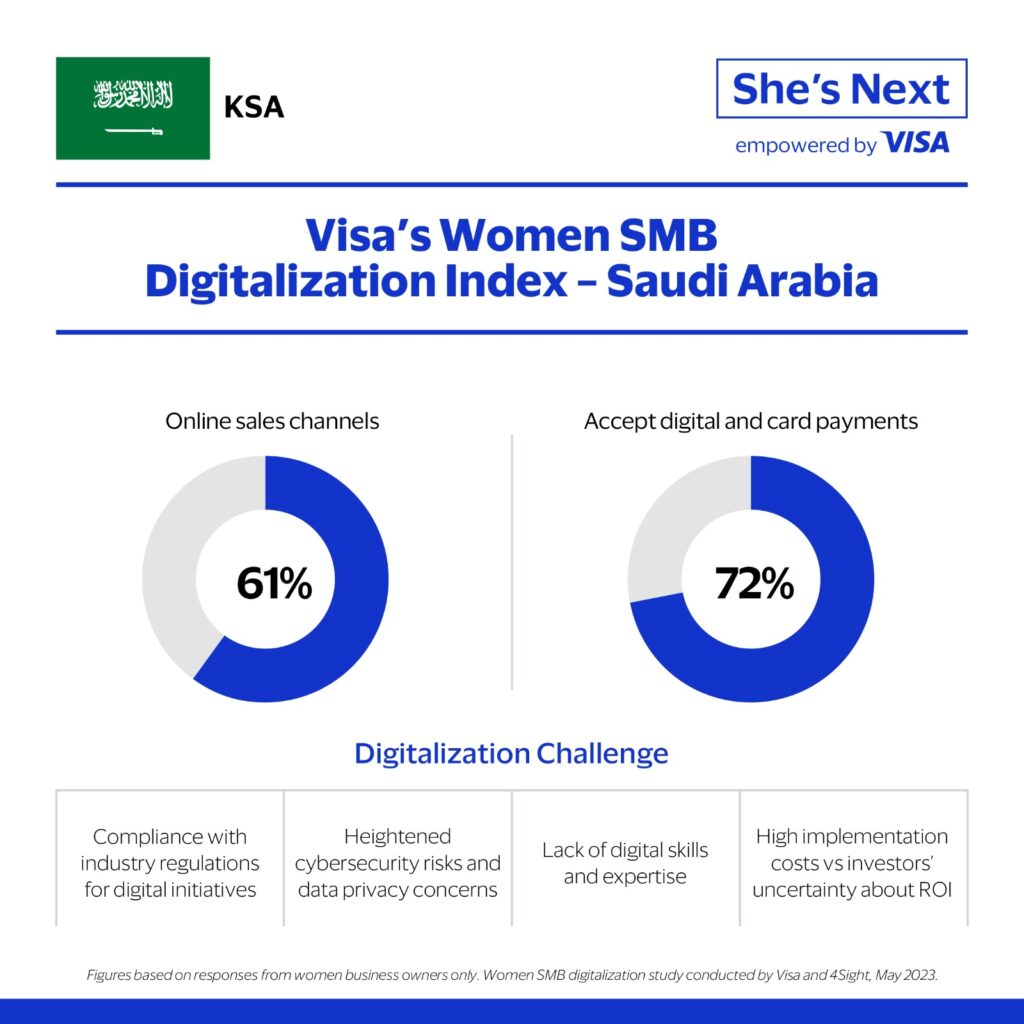

She’s Next is part of Visa’s efforts to support digitalization of women-owned businesses and features the launch of Visa’s first Women SMB Digitalization Index which measures digital maturity using 5 key indicators: online presence, digital payments acceptance, payment security awareness, customer engagement, and customer retention.

Bailoun added: “Women entrepreneurs in Saudi Arabia require additional funding and support in today’s business landscape. The Women SMB Digitalization Index is a central theme of this years’ She’s Next initiative, reinforcing the critical importance of this shift, and showcasing the progress made by local women-owned businesses in joining the digital economy.”

Key findings include:

· Digitalization challenges: Compliance of digital initiatives with industry regulations, increased cybersecurity risks and data privacy concerns, lack of digital skills and expertise, and high cost of implementation vs investors’ uncertainty around ROI.

· Funding sources: Seven in 10 female business owners relied on their personal savings to start their business. If additional funds were available, they would invest in staff expansion, new technologies, and increased security measures.

· Seventy-two percent of women-led businesses accepting cards, and 61% said online was their primary sales channel.

According to Ministry of Communications and Information Technology: “We believe in the significant role of training and enablement for small businesses, particularly those owned by women. By providing resources and support for their growth, we can empower these entrepreneurs to not only succeed, but to thrive in our economy. Visa’s commitment to this mission aligns with our own, and we are excited to work together towards a brighter future for small businesses in the region.”

Mohammed Alamro, General Manager of Entrepreneurship Planning at Monsha’at, said: “Initiatives of this sort are propelling the next wave of innovative female entrepreneurs, which is why we are excited to be working with one of the world’s foremost payment platforms to digitally empower female entrepreneurs across so many sectors throughout the Kingdom.”

Khalid Al Rashed, Head of Retail, Arab National Bank: “By partnering with Visa for the second edition of she’s next in Saudi Arabia, Arab National Bank acknowledges the critical role that small and medium-sized businesses play in driving the economic growth of the Kingdom. With Visa’s cutting-edge payment technology and ANB’s trusted banking services, we are empowering these entrepreneurs with the tools they need to thrive and succeed in today’s competitive market.”

Since 2020, Visa has invested around $3M in over 250 grants and coaching for women SMB owners through the She’s Next grant program globally including in US, Canada, India, Ireland, Ukraine, Kazakhstan, Saudi Arabia, UAE, Egypt and Morocco.