Saudi Arabia’s Non-Oil Sector Powers Economic Growth, Aiding the Real Estate Sector: Savills Riyadh Office Market in Minutes Q4 2023

Despite a projected dip in GDP to -0.5% in 2023 due to strategic oil adjustments, Saudi Arabia’s non-oil sector remained robust at 4.1%, driving the economy towards growth and paving the way for a swift rebound in overall economic growth at 5% in 2024 as oil production in the Kingdom normalises.

The Purchasing Managers’ Index (PMI) for December 2023 held strong at 57.5, reflecting the resilient non-oil sector driven by increasing demand, investment, and exports. This momentum is further fuelled by Saudi Arabia’s ambitious Vision 2030 target of boosting foreign direct investment (FDI) to 5.7% of GDP by 2030, instilling strong investor confidence, particularly among foreign companies.

Ramzi Darwish, Head of Saudi Arabia at Savills Middle East, said: “Riyadh’s office market showcased remarkable agility in Q4 2023, with a 31% surge in office transactions during 2023 compared to 2022. The upward trajectory is expected to continue in 2024, even though rental values will remain stable in Q4 2023, propelled by Vision 2030’s FDI goals, and sustained economic growth.”

The surge in corporate interest is evident as over 180 foreign firms have secured licences to establish regional headquarters (RHQ) in Riyadh, surpassing the initial target of 160. Among these are some of the prominent global corporates that have established their regional headquarters in Q4 2023. reinforcing Riyadh’s status as a magnet for leading players across industries.

Leasing activity tracked by Savills in Q4 2023 revealed legal firms dominating 40% of completed transactions, followed by tech companies, Telecommunication, Media and Technology (TMT) firms, and engineering and manufacturing companies at 20% each. Companies from the pharmaceutical, IT/ITES, and BFSI sectors accounted for 57% of total occupier inquiries.

Interestingly, 70% of inquiries were focussed on office units smaller than 1,000 sqm, indicating a preference for agile, efficient workspaces.

Swapnil Pillai, Associate Director, Middle East Research, Savills, said: “International companies led the surge, contributing to 78% of Q4 2023 inquiries, with the US leading demand at 40%, reflecting growing international interest in Riyadh’s economic potential. The recently announced 30-year tax relief for regional headquarters aligns with Vision 2030 goals.”

Pillai added, “The government’s spending on infrastructure projects is creating significant opportunities and attracting global players to establish a strong presence in the city.”

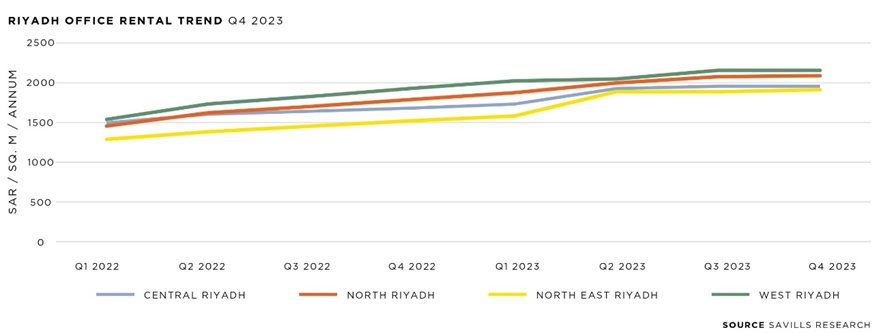

Amid limited prime office space, the Grade A occupancy rate is estimated at 98%, with stable rents observed in Q4 2023 after a significant y-o-y increase of 18%. North-East Riyadh stood out as it experienced the highest rental increase at 26% y-o-y, followed by Central and Northern Riyadh at 17% y-o-y, highlighting its prime location and limited availability.

A surge in supply of more than 800,000sqm of new Grade A office space is likely to be completed by 2025 to respond to the strong increase in demand. This should offer more options for tenants, potentially mitigating dramatic price increases while also catering to sustained demand levels.