MENA REGION OUTPACES EUROPE AS SECOND-FASTEST-GROWING MARKET IN GLOBAL WELLNESS REAL ESTATE BOOM

Dubai emerges as wellness real estate hub as wealthy buyers seek quality of life

The MENA region is outpacing Europe as the world’s second fastest-growing wellness real estate market as wealthy global buyers make quality of life their main investment goal.

The global wellness real estate market, which has more than doubled since 2019, is projected to reach $1.1 trillion by 2029 in a trend that is reshaping the luxury property sector.

According to the Global Wellness Institute (GWI), the MENA region’s wellness real estate market is expanding at just over 22% annually, just behind Latin America–Caribbean (24%), and ahead of Europe (22.4%), and Dubai has emerged as the regional hub.

“Over the last few years, there has been a big change in the way luxury real estate is defined and valued,” says Talal M. Al Gaddah, CEO and Founder of the Keturah luxury brand, which is establishing a strong presence in Dubai.

“Today, buyers seek homes to improve their health and wellbeing. They are now asking, ‘Is this home going to make me healthier? Will it help me sleep better, improve my mood, my family’s well-being? Will it connect me to nature, and give us all the quality of life we need?”

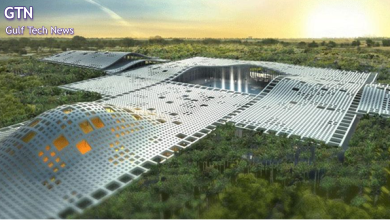

“This was our motivation in developing Keturah Reserve as the first community of its kind in the region where wellness science shapes every architectural decision.”

Interiors across the AED5.7 billion luxury development in Duibai feature natural materials and rich greenery to promote daily wellness. Bio-living features include sophisticated air and water purification systems, as well circadian lighting to improve sleep, mood, and energy levels.

Dubai’s luxury market is shifting from volume-driven growth to innovation-led development, with new projects addressing real lifestyle and health needs that challenge conventions, capture global attention, and reinforce the city’s reputation as a forward-thinking destination.

Most luxury buyers are long-term (5+ years) or medium-term (2-4 years) investors, though the distinction is increasingly based on purpose rather than timeframe, with two distinct profiles emerging.

“The lifestyle investor acquires a unit as a primary or secondary residence, considering it as a long-term sanctuary,” says Talal. “They are committed to holding for at least five years because they are investing in their family’s health and happiness, not merely capital appreciation.

“The strategic investor acknowledges the scarcity value of wellness-focused luxury assets, and recognizes that as the wellness real estate market grows annually in this region, early entrants will appreciate significantly. Generally, they hold for 3-5 years before exiting with substantial returns.”

Both categories of investors are quality-focused and prepared to pay a premium. They also seek assurances that the developer will deliver, that the asset will appreciate, and that they will have viable exit options.

As Dubai’s luxury real estate market continues to flourish, rather than worrying investors, they perceive it as evidence of the market’s vitality and Dubai’s standing as a global luxury destination.