Mastercard New Payments Index 2022:Saudi Arabia Consumers Embrace Digital Payments

Riyadh, Saudi Arabia. gulftech – Adoption of a broader range of digital payment methods is accelerating in the Saudi Arabia and the technology fueling the future of payments is already here, according to Mastercard’s 2022 New Payments Index. In addition to being aware of solutions like cryptocurrency, digital cards, biometric payments, BNPL (Buy Now Pay Later), and open banking, consumers in Saudi Arabia are increasingly and actively using these solutions in their everyday lives.

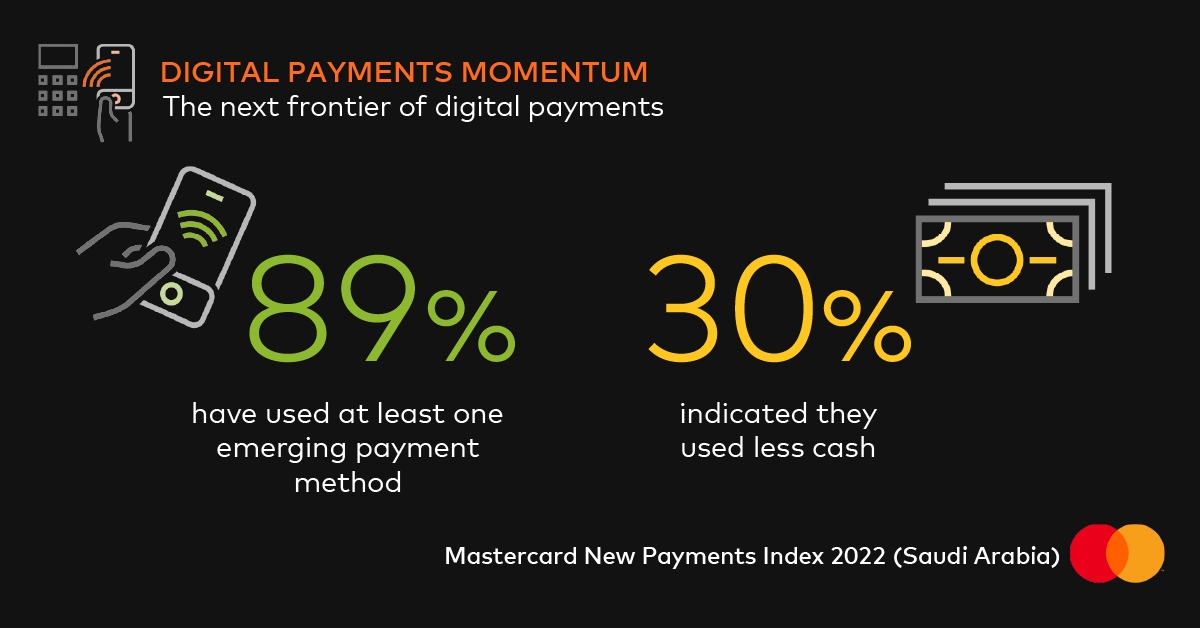

Mastercard’s New Payments Index 2022 found that 89% of people in Saudi Arabia have used at least one emerging payment method in the last year. They include 42% who have used a tappable smartphone wallet, 31% who have used a digital money transfer app, 21% who have used a BNPL installment plan. Consumers are also making purchases in increasingly diverse ways, including through voice assistants and social media apps.

Usage of digital payments increasing, use of cash declining

While traditional payment methods still have traction, 30% of consumers in Saudi Arabia indicated they used less cash in the past year. By contrast, 69% of Saudi users (compared to 61% globally) increased their use of at least one digital payment method in the last year, including digital cards, SMS payments, digital money transfer apps and instant payment services. These behaviors are expected to continue, with comfort and security key to growing adoption.

The Index confirmed security is a key priority when deciding what payment methods to use, globally and in Saudi Arabia (36%). In the Kingdom, rewards and security are followed by considerations for ease of use and promotions. Highlighting sustainability as a key driver in the region, 30% of Saudi consumers said they also consider social and environmental benefits.

“The Kingdom has made significant progress in the pursuit of building an inclusive economy, and it’s fantastic to see that consumers in Saudi Arabia also share an openness for new emerging digital payments methods. This passion for trying new digital solutions and discovering the benefits of an increasingly simpler, convenient and more secure payment ecosystem is being driven by Saudi’s young tech-savvy generation, and is great news for the Kingdom’s future prospects,” said Maria Medvedeva, VP and Country Business Development Lead, Saudi Arabia & Bahrain, Mastercard.

The Mastercard New Payments Index 2022 further shows:

High awareness of Buy Now, Pay Later (BNPL) Installments as a budgeting tool

The majority of Saudi consumers have heard of BNPL with 87% saying they are familiar with the concept, and over half (54%) are already comfortable using it today.Consumers want the flexibility and convenience of BNPL, but with the sense of security associated with a trusted provider like a bank or payment network.

Those that have used BNPL find it useful for planning payments and big-ticket purchases, as well as increased purchasing power. Consumers also find BNPL useful for unique use cases, including as a budgeting and financial planning tool.

Building understanding and education of blockchain technology such as cryptocurrency and NFT is key

In Saudi Arabia, 90% of Saudi consumers above the age of 18 are broadly aware of cryptocurrencies, and 78% have the same broad awareness on NFTs (non-fungible tokens). Approximately 3/4 (74%) of Saudis say they would invest in cryptocurrencies, if understood better. And although two thirds (68%) of consumers in Saudi Arabia think NFTs and other digital assets could be good investments, consumers are looking for more education, security, and flexibility to manage these assets. Official regulation surrounding cryptocurrencies is yet to be approved in the market, however, there is evident interest towards crypto and developing digital currencies.

Most consumers are open to future cryptocurrency engagement, with potential opportunities ranging from holding an investment, to redeeming rewards, to using crypto as means of payment, to purchasing an NFT using a credit or debit card. Stability in the industry is lacking with those familiar with crypto feeling especially strongly about the need for regulation. Banks are presently the most trusted entity to drive digital currencies.

Receptiveness to more direct Account-to-Account (A2A) payments

The majority of consumers are seeking greater agility to optimize bill payments, prioritizing control, flexibility, convenience, and integrated payment technologies. Most consumers are open to direct account-to-account payment options, by linking their account to a merchant site for future purchases. 85%of Saudi consumers using account-to-account payments, have maintained, or increased their usage in the last year.

Three quarters (73% of consumers) agree they are interested in a bill payment option that allows them to change the date they pay their monthly bills, mostly due to an irregular income. Bill payment options that allow them to pay over a period using a buy now, pay later solution (70%) was also of interest, as well as automatic payments for their household bills (72%).

Consumers turning to fintech, and indirectly open banking, to accomplish everyday finance needs

Consumers are relying on digital finance options for their everyday financial tasks, with the benefits of open banking like speed, convenience, and transparency. About three quarters (76%) know about open banking, and are using it to pay their bills, do their banking, secure or refinance loans, and make BNPL payments.

Six in ten (60%) Saudi consumers feel safe using apps to send money to people or businesses from their phone. Four in 10 (45%) are willing to share financial data information with apps to have access to payment tools that help them manage their money.

Biometrics offer convenience and security at checkout, though data access concerns remain

Consumers recognize the convenience that biometrics can offer, with two thirds (66%) agreeing it is easier to make payments using biometrics than a card or device. The potential for security optimization is also evident to consumers, with two thirds also agreeing biometrics tech for payments is more secure than two factor authentication.

While consumers do have some concerns about what entities have access to their biometric data, they are still open to using it given the time it saves, and over half (60%) have used biometrics for at least one purchase in the last year. Five in six (85%) consumers have used or plan to use their fingerprint to make a payment, which was followed by other biometric methods like facial recognition and retina scans.

Emerging payments have strongest traction among more digitally native generations

Younger generations have gone more digital in their purchasing and payments behavior, and their engagement in and usage of emerging digital payments engagement is accelerating at a faster rate than older audiences. They are also more open to exploring emerging payment approaches like crypto or buying virtual products in the metaverse. While security and data privacy remain a concern for them, it is less heightened than for older audiences, and they are more likely to perceive digital tools as secure.

Across Saudi Arabia, Gen Z is less likely than Millennials or Gen X to use cash or make in-person purchases and payments. They are proactively seeking out new payment methods. More than half of Gen Z and Millennials are likely to have obtained a new digital payment alternative (e.g., digital wallet, click-to-pay account) compared to only 36% of Gen X and 4% of Boomers.

As consumers shop, bank, and transact digitally more than ever before, Mastercard continues to strengthen its digital payment capabilities in Saudi Arabia and the wider EEMEA region. Its trusted technology solutions are being used for new use cases, brought to market through various partnerships with fintechs, governments, financial institutions, digital giants, and telecom operators. By tapping into multi-rail capabilities to create competitive localized solutions, Mastercard is accelerating the transfer of value in new ways, on multiple rails, thereby advancing a bright future for inclusive commerce.