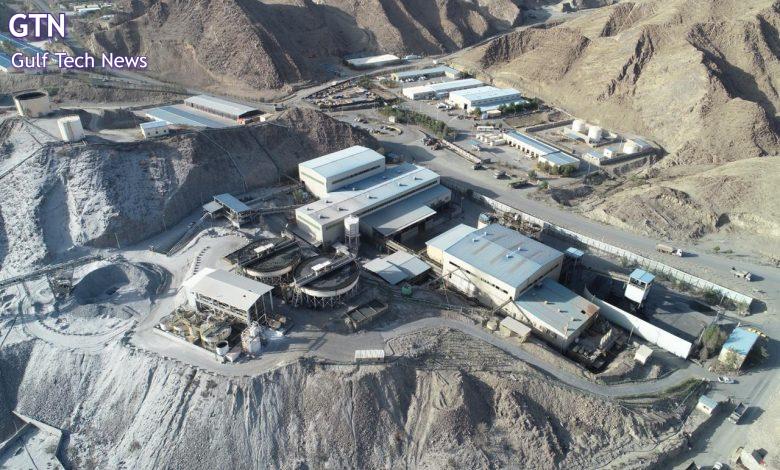

AMAK Achieves Strong Growth with 181% Increase in Net Profit to SAR (137) Million in YTD SEP 2024

Financial performance underscores AMAK’s effective capitalizing on favorable market trends and consistent delivery of value to shareholders, supporting the growth of Saudi Arabia’s mining sector under Vision 2030.

Almasane Alkobra Mining Co. (AMAK) reported robust financial results for the period ended Sep 2024, with net profit rising by 181% year-on-year (YoY) to SAR 137 million, compared to SAR 49 million in the same period of the last year.

AMAK’s current period growth is primarily attributed to a 108% YoY increase in gross profit, reaching SAR 198 million. This strong performance was driven by higher prices for copper, zinc, and gold, coupled with increased sales volumes of copper and zinc.

The company also benefited from reduced financing costs and enhanced operational efficiencies, further strengthening its financial performance.

Period ended 30 Sep 2024 Financial Highlights (SAR Million)

- Revenues: SAR 554 million, up 48% from SAR 373 million compared to the same period of the last year.

- Gross Income: SAR 198 million, an increase of 108% from SAR 95 million in the prior-year period.

- Operating Income: SAR 149 million, up 183% from SAR 53 million in the same period last year.

- Net Income: SAR 137 million, a 181% rise from SAR 49 million in the same period of last year.

- Earnings Per Share (EPS): SAR 1.55, up from SAR 0.55 in period ended 30 Sep 2024.

AMAK’s solid financial performance in current period ended 30 Sep 2024 builds on our outstanding results from the first nine months of the year and highlights the company’s resilience and strategic focus on production enhancement and operational efficiency,” said Geoffery Day, CEO of AMAK. “With our new growth strategy we are confident that 2024 will be a record year for AMAK.”

Strong Balance Sheet

As of the end of September 2024, AMAK’s shareholders’ equity (excluding minority interest) reached SAR 1.2 billion. This growth reflects the company’s commitment to strengthening its financial foundation and consistently delivering value to shareholders.

Looking Ahead

AMAK’s strong financial performance in both Q3 and first nine months of 2024 underscores the company’s resilience and strategic emphasis on production growth and operational efficiency. Building on this momentum, AMAK recently unveiled a comprehensive growth strategy aimed at increasing production capacity and enhancing its presence in the mining industry.

Central to this strategy is the expansion of its processing plant, which is expected to significantly boost output in the coming years.

These initiatives, along with the appointment of new leadership, position AMAK to capitalize on favorable market trends, deliver long-term value to shareholders, and contribute to the broader development of Saudi Arabia’s mining sector in alignment with the Kingdom’s Vision 2030.