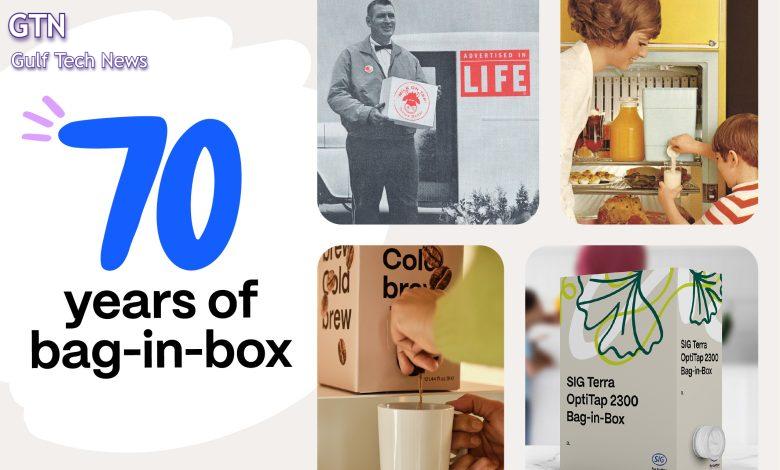

SIG celebrates 70th anniversary of bag-in-box invention

This year, SIG celebrates the 70th anniversary of the invention of bag-in-box, a groundbreaking innovation that has become a core part of the company’s packaging portfolio. Originally developed in 1955 by American chemist, William R. Scholle, as a safer, less expensive, and more convenient solution for transporting and storing industrial liquids, bag-in-box quickly gained traction across multiple industries, particularly food and beverage.

Following the acquisition of Scholle IPN in 2022, bag-in-box has evolved into a fully integrated packaging system offering for SIG.

SIG is the global leader in bag-in-box production with manufacturing facilities on five continents and delivering integrated systems worldwide.

Together with a unique portfolio that includes aseptic and chilled carton, and spouted pouch solutions, SIG has become a significant player in global food and beverage packaging across a wide range of categories, channels, and use occasions.

Packaging innovation turned industry standard

Decades of experience and a deep industry understanding have turned the bag-in-box innovation from 1955 into an integrated packaging system, including films, fitments, and patented filling equipment, for foodservice, retail, and industrial applications. Among others, the systems are used for product categories like post-mix syrup, juice, dairy, edible oil, processed fruits, water, and foodservice, as well as non-food categories like paints and coatings, cleaning chemicals, laundry care, and agricultural chemicals.

The evolution of bag-in-box over the years reflects changing consumer habits and trends as well as industry demands. And yet, the inventors of bag-in-box were always one step ahead in the evolution of the system. In the 1950s, the company was the first to attach molded fitments to bags, providing more efficient filling.

The 1960s saw the development of automatic bag-in-box filling equipment and packaging solutions for dairy. The company further expanded its reach in the 1970s with the launch of the first high-acid aseptic bags and filling equipment for the processed food industry, as well as the introduction of bag-in-box packaging for dispensing post-mix syrups in the beverage industry.

In the 1980s and 1990s, the company pioneered low-acid aseptic-capable bags for the dairy industry and developed high-speed, continuous-web filling equipment for bag-in-box packaging. The 2000s marked another step forward with the introduction of specific barrier films for bag-in-box water packaging and aseptic-capable fillers for both low- and high-acid products.

The 2020s have been defined by the development of recycle-ready films for bag-in-box use and APR (Association of Plastic Recyclers) recognition for meeting the highest criteria for recyclability according to the APR Design® Guide for Plastics Recyclability for its bag-in-box packaging for water and beverages such as post-mix syrup. The company also innovated a range of connector fitments that integrated seamlessly into food and beverage dispensers, drastically improving foodservice operational KPIs across the world.

Enhancing efficiency and flexibility

SIG’s bag-in-box solutions provide a multitude of advantages for customers across industries. Whether for foodservice, retail, or industrial applications, the packaging systems ensure product integrity, efficient dispensing, and operational flexibility. With proprietary barrier materials that preserve food quality and safety, SIG’s solutions ensure product protection and convenience.

Samuel Sigrist, CEO of SIG: “We are extremely proud to have such a diverse and dynamic solution in our SIG portfolio, as well as employees who are passionate about our packaging systems. Today’s SIG combines the expertise of so many outstanding people who enable us to grow and innovate. This year we celebrate not only the 70th anniversary of bag-in-box, but also the many opportunities we see for the future.”

Based on the principle of “invented for better – engineered for the future”, one of SIG’s main focuses in bag-in-box solutions is smart dispensing in the foodservice industry. With its connector technology, SIG enables customers around the world to easily connect their products to leading food and beverage dispensing technologies.

SIG’s sterile, closed-loop dispensing systems minimize the risk of product contamination and extend product shelf life even after opening. In addition, the system’s high evacuation rates – up to 99% – reduce food waste and improve cost efficiency.

Commitment to sustainability

With the recent launch of a recycle-ready bag for water in a bulk packaging format in Australia, SIG continues to pioneer the industry toward circular packaging solutions. Its SIG Terra RecShield bag-in-box packaging material eliminates aluminum from bag-in-box packaging and replaced it with a unique polymer composition, making the complete packaging recycle-ready.

“Innovation never stops,” said Glenn Wiechman, Vice President, Global Business Line – Bag-in-Box at SIG. “After 70 years as the pioneer in the bag-in-box sector, we are setting the course for an even more sustainable future, reducing the carbon footprint and working towards a circular packaging system.

Our bag-in-box solutions are now used by millions of consumers around the world as part of their everyday lives. From packing fruit and vegetables and hygienically serving food in restaurants, schools, and hospitals to celebrating a delicious milkshake – we are part of it with our unique solutions.”

As SIG celebrates this anniversary, it remains committed to advancing bag-in-box technology for the next generation, ensuring sustainable, efficient, and high-performance packaging solutions for industries worldwide. Already now, bag-in-box packaging has a high product-to-package ratio, which means a high amount of product can be packaged with very little material. The ultimate goal is to retain the inherent environmental benefits of bag-in-box, like low material use and carbon footprint, while making every pack easy to recycle.