Saudi Arabia Tops the Global Chart in Click-and-Mortar Shopping, Especially the Younger Consumers: PYMNTS-Visa Acceptance Solutions Study

- In Saudi Arabia, more than half (55%) of consumers prefer Click-and-Mortar™ shopping strategies, surpassing the global average (39%)

- Younger consumers in Saudi Arabia show even stronger preference, with nearly 6 in 10 millennials having shopped via Click-and-Mortar™ most recently

- Saudi Arabian merchants offer an average of 28 digital shopping features of the 34 features identified in the study – ranking higher in this metric than merchants in any of the other six countries

- 71% of consumers in Saudi Arabia cite price matching as a key feature they expect from merchants

- Click-and-Mortar™ experiences improves customer satisfaction in Saudi Arabia by 66% compared to traditional in-store shopping

Saudi Arabia has emerged as the global leader in Click-and-Mortar™ shopping, with over 55% of consumers favoring this hybrid shopping method—well above the global average of 39%, according to a recent study by PYMNTS Intelligence and Visa Acceptance Solutions.

The ‘2024 Global Digital Shopping Index: KSA Edition’ highlights that Saudi Arabia’s millennial shoppers are driving this trend, with nearly 6 in 10 reporting they have most recently shopped using a Click-and-Mortar™ approach.

The study, conducted between September and December 2023, surveyed 1,392 consumers and 414 merchants in Saudi Arabia which is offering a comparative insight from a broader survey of 13,904 consumers and 3,512 merchants across seven countries, including Brazil, India, UAE, Mexico, the U.S., and the UK.

The study highlights emerging trends in consumer behavior, documenting the rise of Click-and-Mortar™ shopping experiences, where digital tools seamlessly integrate with physical locations. This hybrid approach is replacing the traditional divide between online-only and in-store-only shopping.

In Saudi Arabia, the demand for an enhanced Click-and-Mortar™ experience is strong. Saudi merchants offer an average of 28 digital shopping features out of the 34 identified in the study—ranking higher in this metric than merchants in any of the other six countries surveyed.

However, while Saudi merchants provide a variety of digital features, consumers often have difficulties accessing them.

The most frequently overlooked feature is the ability to use a mobile device to locate products in-store, with 28% of shoppers expressing interest in using this feature but being unable to find it.

Price matching and the option to set up a digital profile with merchants are also in demand, with 27% of respondents reporting they would use these features if they were more accessible.

These findings underscore the importance of making these features more visible and user-friendly to improve customer satisfaction.

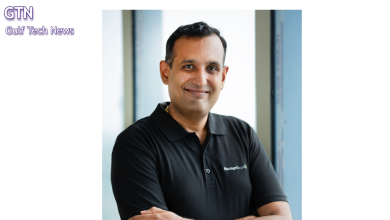

Ali Bailoun, Regional General Manager for Saudi Arabia, Bahrain and Oman at Visa, emphasized on the critical importance of digital innovation in today’s retail landscape as merchants cater to the diverse and young consumer base in KSA.

“Our data shows Click-and-Mortar™ shoppers in Saudi Arabia report a 66% higher satisfaction rate compared to those who rely solely on in-store shopping without digital assistance,” Bailoun said.

He added, “Click-and-Mortar™ is the cornerstone of future commerce. As a leader in payment solutions, Visa is dedicated to helping merchants with our innovative suite of Acceptance Solutions, including the Visa Acceptance Platform and Tap to Phone, both designed to meet the needs of Click-and-Mortar™ businesses.

This aligns with the Kingdom’s Vision 2030 initiatives aimed at driving digital transformation and financial inclusion. Alongside partner investments in building a strong digital infrastructure, these initiatives are key to delivering a seamless customer experience in Saudi Arabia, as demonstrated by the achievement of the 70% non-cash transaction rate two years ahead of the 2025 target.”

Key findings from the survey include:

Merchants in Saudi Arabia should focus on offering consumers their most desired digital shopping features—and ensuring they are easily accessible:

- On average, merchants in Saudi Arabia offer 28 out of the 34 features identified in the study, surpassing their peers in all other countries surveyed, including the UK and the U.S.

- The ability to use a preferred payment method is the most sought-after feature, with 77% of local shoppers identifying it as a key benefit. Other top features include easy-to-navigate stores and shopping carts (73%), and mobile-optimized websites or apps (72%).

- Price matching is also highly valued, with 71% of consumers citing it as a key feature, though nearly a third reported difficulty finding it.

Demographics significantly influence Click-and-Mortar™ shopping strategies.

- Saudi consumers used an average of 14 digital features in their most recent shopping experience.

- Younger shoppers tend to use more features, with millennials using 16 and Gen Z using 15. Women also engage with slightly more features than men, using 16 versus 14, while older consumers use fewer, though baby boomers and seniors still engage with an average of eight digital features.

- There is a clear opportunity for merchants to expand their digital offerings to meet the growing demand for Click-and-Mortar™ experiences.

Offering Click-and-Mortar™ experiences gives physical stores a competitive edge over online-only merchants.

- Click-and-Mortar™ shoppers in Saudi Arabia experience a 66% increase in satisfaction compared to those who shop exclusively in-store.

- Satisfaction is particularly high for pickup purchases, with an 81% increase over traditional shopping.

- Digitally assisted in-store shopping also delivers a 60% satisfaction boost compared to traditional methods.

- These findings highlight the power of Click-and-Mortar™ experiences in helping physical stores remain competitive with online-only shopping experiences, which produce the highest index scores of any channel in Saudi Arabia.

Distinct Shopping Trends Emerge Between Grocery and Non-Grocery Segments

- 44% of grocery shoppers rely on traditional in-store shopping without digital assistance, while 7.7% used online channels.

- In contrast, 44% of non-grocery shoppers choose online shopping, while only 7.5% rely on traditional in-store shopping without digital support.

- Approximately 50% of both grocery and non-grocery buyers prefer Click-and-Mortar™ experiences, combining online and in-store shopping.

These trends highlight a strong preference for Click-and-Mortar™ strategies in both segments. While traditional and remote shopping channels serve distinct purposes, integrating digital features with physical stores is key to enhancing customer satisfaction and addressing a diverse set of shopping preferences.