Saudia Dairy and Foodstuff Co. reports strong third quarter financial results

Saudia Dairy and Foodstuff Co. reports strong third quarter financial results

Jeddah, Saudi Arabia:Gulf Tech

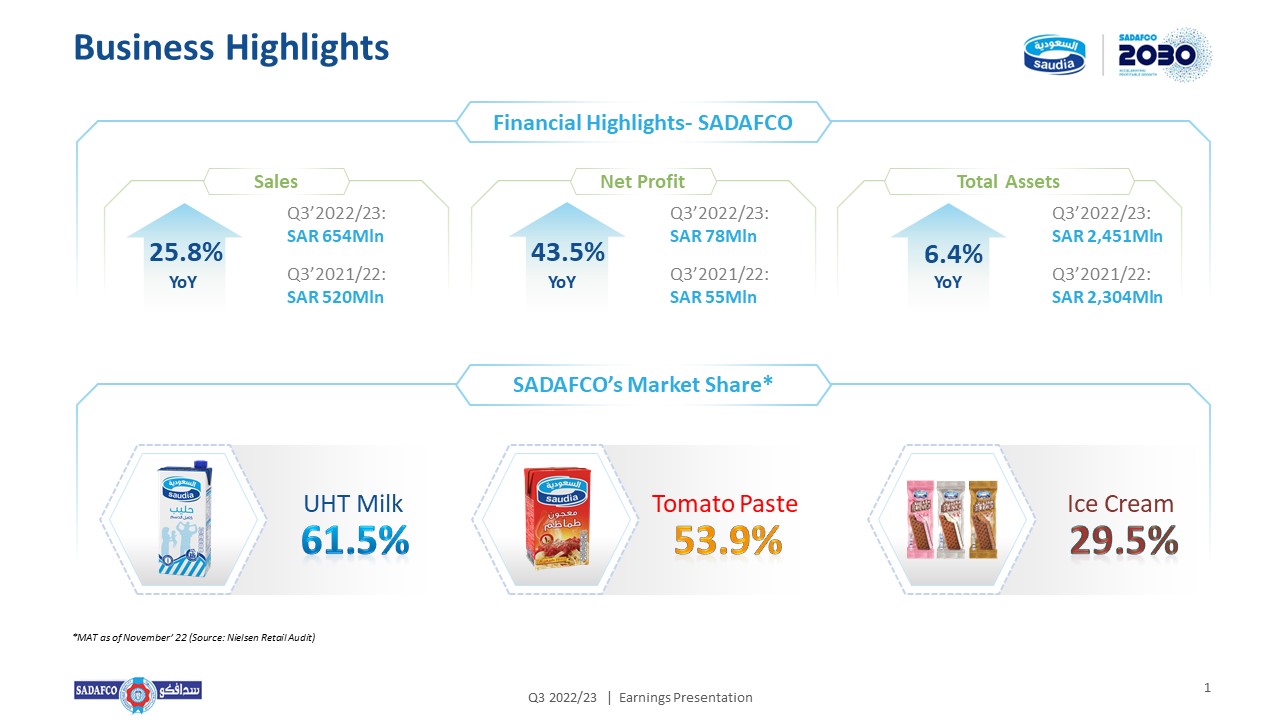

Saudia Dairy and Foodstuff Co. (SADAFCO), the leader in the UHT (long life) milk market in the Kingdom of Saudi Arabia reported a significantly higher net profit of (43.5%) for the quarter compared to the same quarter last year.

The company reported total profit SAR 78.3 million for the quarter, a 43% increase in comparison to the previous year’s results of SAR 54.6 million. The company attributed the increase to increased focus on sales efficiency, route optimization and channel profitability. Overheads were controlled effectively and were spent primarily on advertising and sales activities (in preparation for Ramadan sales).

Patrick Stillhart, CEO, SADAFCO said: “Our progressively strong financial results reflect the strength of the Saudia brand and the prudent decision making by the Board and the management. Our market shares remain robust with very positive trending lines, further strengthening our position in the respective categories. Dec shares were at: UHT Milk 64.4%, Tomato Paste 54.7% and Ice cream 32.0% (highest share ever). Moreover,we had strong double-digit volume growth in Q3, in particular in the month of December (+16%). We continue to delight our consumers through new offerings especially in the ice cream and dairy categories.

ESG continues with initiatives relating to reduction of electricity through solar panels, water saving and recycling of water and packaging materials. “

SADAFCO also reported robust financial results of SAR 220.7 million net profit for the 9 months ending 31st December, 2022. In comparison to the previous year, the results show a 50.9% increase in profit from SAR 146.3 million. Sales higher by 28.4% in SAR terms by 437 Mln across all categories and channels. Gross margin of 31.4% vs 30.6% reflects increased focus on prudent buying strategies, efficiency in manufacturing operations and focus on profitable growth.

As SADAFCO continues to enhance its capabilities to meet future demands and as part of their growth strategy, work continues on new Makkah depot to be operational in next financial year. The financial position of SADAFCO remains strong with SAR 634 million cash balance. In January 2023 dividend of SAR 3 per share was paid as interim dividend.