Finastra event highlights key considerations when launching a digital bank

Finastra, in partnership with Connect Global Group, brought together senior stakeholders in financial services for a virtual event, to discuss the most common mistakes made when launching a digital bank, and most importantly how to avoid them.

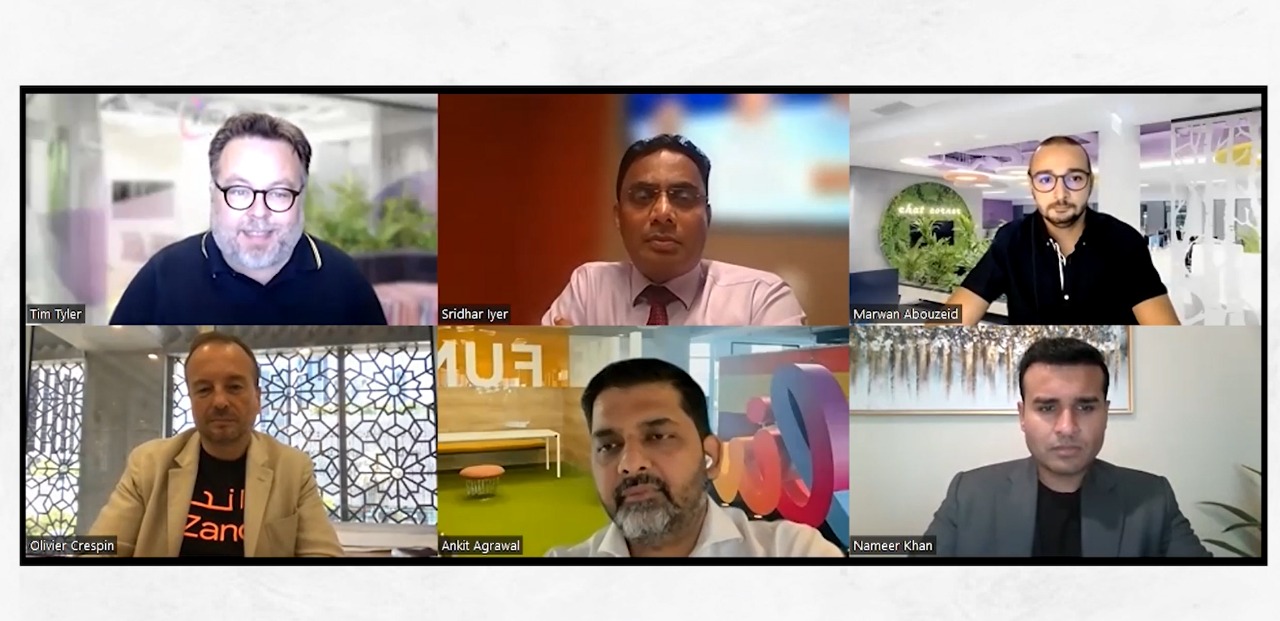

Moderated by Tim Tyler, Head of Strategic Advisory, Universal Banking, Finastra, the panel included: Nameer Khan, Chairman and Founding Board Member, MENA Fintech Association; Ankit Agrawal, VP, Head of Customer, Products and Operations and Co-Founding Member, Liv. Digital Bank by Emirates NBD; Sridhar Iyer, Executive Vice President and Head of Mashreq Neo, Mashreq Bank; Olivier Crespin, Co-Founder and CEO, Zand; Marwan Abouzeid, Global Principal Solutions Consultant, Finastra.

Tim Tyler opened the discussion with insight on the financial services landscape, noting: “Whereas fintechs often operate with a ‘move fast break things’ mentality, banks, as highly regulated entities, face higher risks of penalties when things go wrong. Digital banks strike a perfect balance of the startup world with the security of banking, however, there are many challenges with getting this right. One big question to ask is do banks transform or respawn? Will the winners be the digital startups, or the digital spin-offs?”

5 key considerations highlighted by the panellists are:Building on an old tech stack: To launch a digital child or sibling, building on an existing tech stack might accelerate time to market. However, innovating in the front-end with archaic processes in the backend (including paper), will stymie growth and customer experience. A software provider can help banks quickly upgrade their operations, utilize the cloud and seamlessly integrate with fintechs. To remain competitive, banks can’t build all capabilities on their own.

Focusing solely on monetization: Incumbents have the resources and legacy of customer trust to launch a digital bank. This is often absent for new players and reaching profitability takes time. Digi-tal banks may also need a full banking license which is time-consuming and expensive to obtain. These players shouldn’t focus on immediate monetization, but on building a technology infrastructure focused on customer demands. The platform should deliver trust, and a higher share of wallet will fol-low.

Hiring for traditional banking: Digital banks require people with financial expertise and experience in running a bank, but who are ready to embrace change. They also need people, often from bigtech companies, who think like a customer and can leverage data and analytics. Remember, those running a bank might not be suitable for building a bank. Hiring the right balance of people should be a priori-ty.

Tackling new problems with an old mindset:

Teams in incumbent banks often work in siloes. Or-ganizational structure can help to determine how to disrupt existing processes and promote innova-tion, however, digital banks require a new, open culture which allows new use-cases and ideas to flow. Collaboration and a design-thinking approach is important to eliminate outdated solutions and processes and to brainstorm new ideas without restrictions. Inviting customers to contribute can add value too.

Focusing on standalone products: Banking today is led by consumers who want digital services, in context, to suit their lifestyle. As brands embrace embedded finance, financial services are no longer confined to “traditional” channels. Banks therefore need to move away from focusing on standalone products and towards ‘feature play’. Eventually, financial services providers will live behind brands, with products and services tailored for that context.

Speaking on the panel, Marwan Abouzeid said, “It’s been a knee-jerk reaction for incumbent banks to look at their existing technology and solutions and create a roadmap to be a part of this new world. Launching a digital bank gives them the opportunity to make mistakes, learn from them and bring the best concepts and ideas back to the mainstream. Additionally, newer players have helped to bring forward customer-first banking. The digital banking landscape is progressing rapidly; it’s an exciting area to be involved with.”